"TIME" Announces German Chancellor Angela Merkel as 'Person of the Year'

Harry Arter dedicates Manchester United victory to family after heartbreaking week

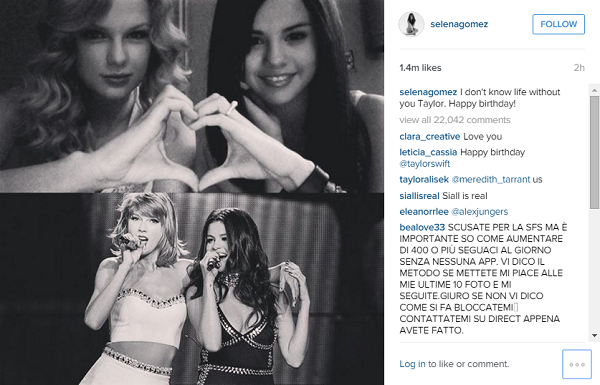

Taylor Swift to Release '1989' Concert Special on Apple Music

Government won't offer a special tax season enrollment period this year

History made as Saudi elects first female councillor

Police raid home of man said to be founder of bitcoin

Presidential Hopeful Donald Trump Has Huge Lead Over Republican Rivals, Poll Finds

Ben Carson rules out third-party run

White House hopefuls mark World AIDS Day

Tons Of Cocaine Disguised As Wooden Pallets

Taliban attack Kandahar airport, 37 killed

The San Bernardino Terrorists Were Likely Planning "Multiple" Attacks

Keurig bought by firm that owns Peet's Coffee

Trump calls Cruz a 'maniac' as he gains traction in the polls

Sushma to make statement on Pakistan visit on Monday